Diversifying payment methods in 2025: cards, mobile, and wallets enhancing the customer experience

As technology progresses, payment methods are constantly evolving. This transformation leaves retail brands weighing several key considerations: Which solutions should be adopted? Should they follow emerging trends? How can they ensure both seamless payment processes and secure transactions?

In the realm of unified commerce, selecting the right payment solution is a strategic imperative. It assures a cohesive experience across all channels. This article delves into the major advancements in payment methods and provides actionable strategies to turn these shifts into opportunities.

The evolution of payment methods in 2025

Emerging payment trends

Payment methods are advancing towards increased fluidity. Biometric payments enable authentication of banking transactions via facial recognition or fingerprint scans, enhancing both user experience and security. Already implemented in some Asian markets, these technologies are progressively spreading to Europe and the United States.

Additionally, Open Banking-based payment modes are on the rise. This method allows merchants to offer direct online payments from a consumer’s bank account, sidestepping traditional credit card networks and reducing transaction fees.

Cryptocurrencies and central bank digital currencies are also emerging. Various central banks, including the European Central Bank, are exploring their operational implementation, potentially leading to cheaper cross-border payments.

Furthermore, split payments are rapidly gaining popularity, both online and in-store. France leads Europe with 23% of consumers using split payments for online purchases. For 45% of European buyers, the ability to make split payments is a determining factor. However, handling the risks associated with deferred payments poses a challenge for merchants.

The impact of new technologies on payment methods

SoftPOS, a technology that transforms a smartphone into a secure payment terminal, is a major innovation. This payment method streamlines the checkout process for merchants by eliminating the need for hardware. With only a dedicated application and NFC technology, any business can now accept contactless card payments.

This payment method opens new opportunities for businesses. They can accept a wider variety of payment methods, including bank cards and digital wallets like Apple Pay or Google Pay.

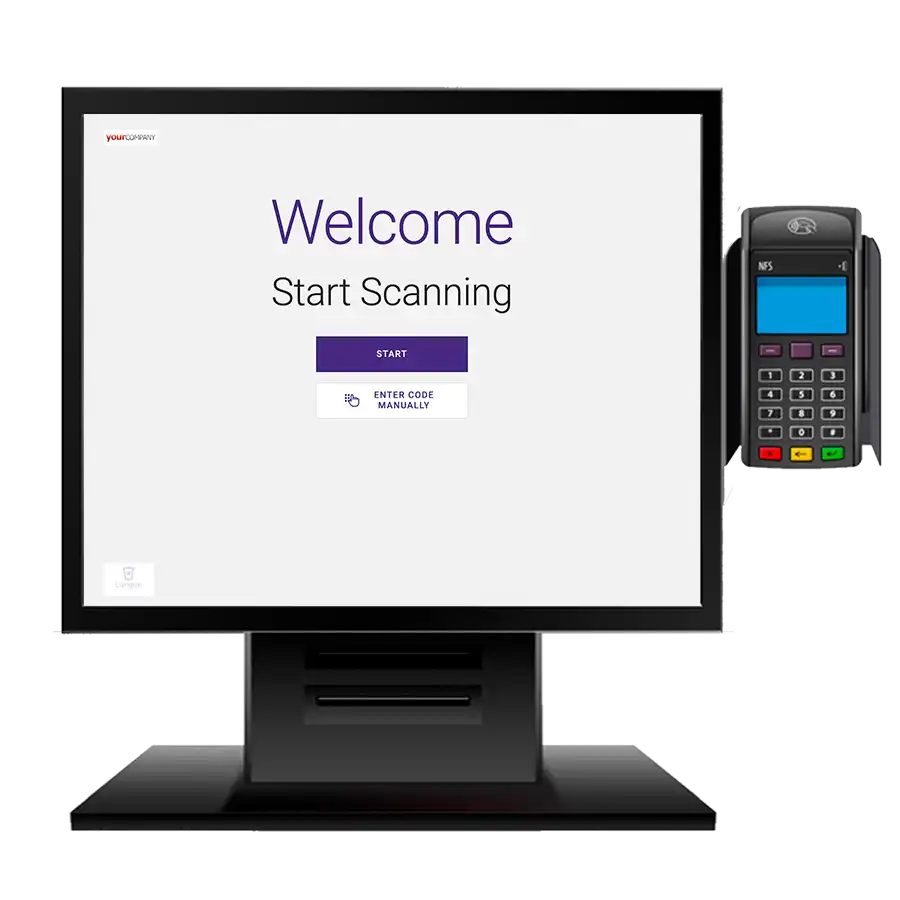

Openbravo SCO integrates various payment methods: bank cards, digital wallets, mobile payments… Designed to adapt to different contexts, Openbravo SCO easily manages currencies, providing a consistent shopping experience regardless of the country.

Innovative payment methods

Bank cards and their digital alternatives

Bank cards remain the primary choice for online transactions, with 93% of French people using them for their purchases. These cards have evolved to include features tailored for online payments, such as single-use virtual cards, providing consumers with enhanced control over their expenses and increased security against fraud.

Digital wallets, meanwhile, consolidate multiple payment methods, including bank cards, into a single, secure online environment. Their appeal lies in:

- Simplified management of financial transactions;

- Instant refunds;

- Seamless integration with other online services.

In France, digital wallets made up 28% of online payments in 2023, a figure projected to rise to 41% by 2027.

The role of mobile payment methods

Tap on Phone technology enables merchants to use their smartphones as contactless payment terminals. This innovation makes transactions accessible to all types of businesses, particularly mobile ones, with a straightforward setup through a dedicated app, addressing the current demands for agility and flexibility.

Driven by consumer expectations for swift mobile payments, the success of Tap on Phone lies in its intuitive use: simply bringing the customer’s bank card or smartphone close to the merchant’s smartphone completes the transaction.

Adopting mobile payment systems opens new avenues for managing commercial data. Associated apps provide enhanced tracking of card transactions and facilitate integration with inventory management systems.

Effective payment methods require the right POS software. Unsure which one to choose? Explore our guide.

Security of payment methods

Protected data during payments

Securing payment data fundamentally relies on the reliability of cloud services. Choosing tools that offer high levels of protection is crucial, and securing SaaS environments is essential to safeguard data effectively.

Beyond this foundation, data security depends on the implementation of end-to-end encryption technologies. These technologies significantly reduce the risks of hacking and interception during online transactions, whether with card payments or bank transfers.

Tokenization provides another layer of security, replacing sensitive information such as card identifiers with unique, context-specific tokens. Consequently, even if data breaches occur, the exposed banking information remains unusable.

The influence of payment methods on customer satisfaction

High perceived security levels bolster consumer trust in a business. Integrating security expectations directly into the user experience through smooth yet robust authentication helps maintain a balance between protection and convenience.

Additionally, transparently communicating how user data is processed, stored, and secured reassures customers. Brands like Apple and Amazon have set industry standards in this regard, establishing transparency as a norm for secure data management.

Optimizing the purchase journey for e-merchants

Strategies to increase conversion rates

Optimizing the payment experience involves streamlining transactions to reduce cart abandonment. Successful e-merchants simplify the process, for example, with one-click payments. Another effective strategy is diversifying payment options, such as offering installment payments, which diminish friction related to perceived costs and promote immediate purchases.

Personalizing the shopping experience is also on the rise, particularly through artificial intelligence that suggests preferred payment options based on the customer’s previous behavior. Some systems tailor payment choices to the cart amount, making the purchase process more intuitive and smoother.

Moreover, the widespread adoption of mobile payments enhances business performance, especially in physical stores. Mobile payments and self-checkout options reduce wait times at checkout, elevating customer satisfaction and boosting conversion rates.

Recommendations for diversifying payment options

To meet consumer expectations, e-merchants should incorporate a diverse range of payment tools that can seamlessly integrate into their existing platforms. A modular approach with open APIs facilitates the quick incorporation of various payment methods without disrupting the user experience.

Implementing these modules into a single, unified platform is a crucial strategic step. A centralized platform simplifies payment management, enhances data analysis, and provides real-time visibility over all transactions. Practical implementation should rely on SaaS solutions renowned for their ease of integration with different payment methods, reducing deployment times and ensuring regular updates.

Openbravo SCO is a comprehensive, interoperable SaaS solution designed to enhance customer satisfaction. It offers an intuitive self-checkout process and optimizes in-store operations. Discover how to easily integrate Openbravo SCO into your existing infrastructure!

Both online and in-store, consumers now expect seamless, secure, and personalized experiences. Adopting innovative tools like installment payments addresses these expectations while optimizing commercial performance.

To capitalize on these new practices, businesses must rely on a unified and interoperable payment infrastructure. Choosing the right POS software is crucial for ensuring a smooth customer journey, reliable transactions, and adaptability to future innovations.

Frequently asked questions

What are the benefits of offering multiple payment methods?

Providing various payment options helps to:

- Increase conversion rates by reducing cart abandonment;

- Improve the shopping experience by accommodating individual preferences;

- Boost consumer confidence through enhanced flexibility and security in transactions.

Which payment methods should you offer your customers?

The optimal payment methods include:

- Bank cards and digital cards;

- Digital wallets;

- Installment payments.

Which payment method should you prioritize?

The best choice of payment method depends on the context. Open Banking transfers often incur lower fees than card payments, checks, or cash.

Digital wallets present a secure, faster alternative to cash or check payments, though some consumers still prefer checks and cash for budget control reasons. Cash payments remain common in convenience stores.

How to select the right payment method for your business?

Choosing the right payment method entails assessing your customers’ preferences. Some prefer bank transfers to reduce fees, while others opt for cash or check payments based on their activities. Ensure the compatibility of selected payment methods with your bank, account type, and POS software.