Margin rate and markup rate: understanding the formulas to enhance profitability

Although margin rate and markup rate are closely linked, they measure different aspects of profitability; margin rate compares the margin to the purchase cost, whereas the markup rate relates it to the selling price. Properly differentiating these terms is key to effective profitability management and coherent pricing strategies. By using straightforward formulas and practical examples, you can analyze your financial indicators and fine-tune your business management.

Monitoring your daily in-store sales KPIs is essential, but mastering your retail margin should be a top priority. This is a critical component of your business’s profitability. The goal is to better manage your sports retail brand and maximize store profitability.

How can you calculate your retail margin? What is the margin rate? How does it differ from the markup rate? Which strategies can optimize profitability? This article provides all the answers.

Margin and margin rate

Understanding retail margin

Understanding the concept of retail margin is fundamental before diving into the margin rate. Retail margin is the difference between the selling price of a product or service and its purchase or production cost. This calculation reflects the profit earned per unit sold by your company. Usually, retail margin is expressed either in absolute terms or as a percentage of the selling price.

Gross margin measures the difference between total revenue and the cost of goods sold or production. This figure reflects the profit before operating expenses, such as personnel, marketing, administration, and taxes, are deducted. Gross margin provides a clear picture of profitability by accounting for only the direct costs related to product purchases.

Conversely, net margin, also known as profit margin, is calculated by subtracting all operating expenses from total revenue. This metric offers insight into the overall profitability of your business.

Gross margin and net margin can vary greatly between companies due to factors like cost structure, market competition, and pricing strategies. Regularly reviewing these indicators is essential to assessing your financial performance and making informed decisions to enhance profitability.

Margin rate

Margin rate represents the retail margin as a percentage of the selling price. It helps assess the profitability of a store, product range, or individual product by indicating how much of the selling price is profit.

There are two ways to calculate the margin rate:

- Unit retail margin rate, which evaluates profitability on a product-by-product basis: Net selling price – Net purchase cost = Unit retail margin

- Overall retail margin rate, which assesses the overall profitability of your business: Net revenue – Net purchase costs = Overall retail margin

Margin rates are crucial for negotiating product purchase prices with suppliers. They help determine if your selling prices ensure profitability while remaining competitive and distinct in the market.

Margin coefficient

The margin coefficient offers another way to express margin rates and assess product or store profitability. While the margin rate evaluates profitability as a percentage, the margin coefficient helps calculate the selling price from the cost. This is particularly useful for determining selling prices:

Coefficient of 1 = no margin

Coefficient of 2 = 100% margin rate

Coefficient of 1.5 = 50% margin rate

Coefficient <1 = loss

Example: to achieve a 50% margin on a product, multiply the purchase cost by 1.5 to obtain the minimum selling price.

Mark-up rate

Definition of markup rate

The mark-up rate, expressed as a percentage, indicates the gross retail margin within an item’s net selling price (excluding VAT). It can be analyzed by categories, product ranges, stores, sales channels, etc. A higher mark-up rate signifies greater profit.

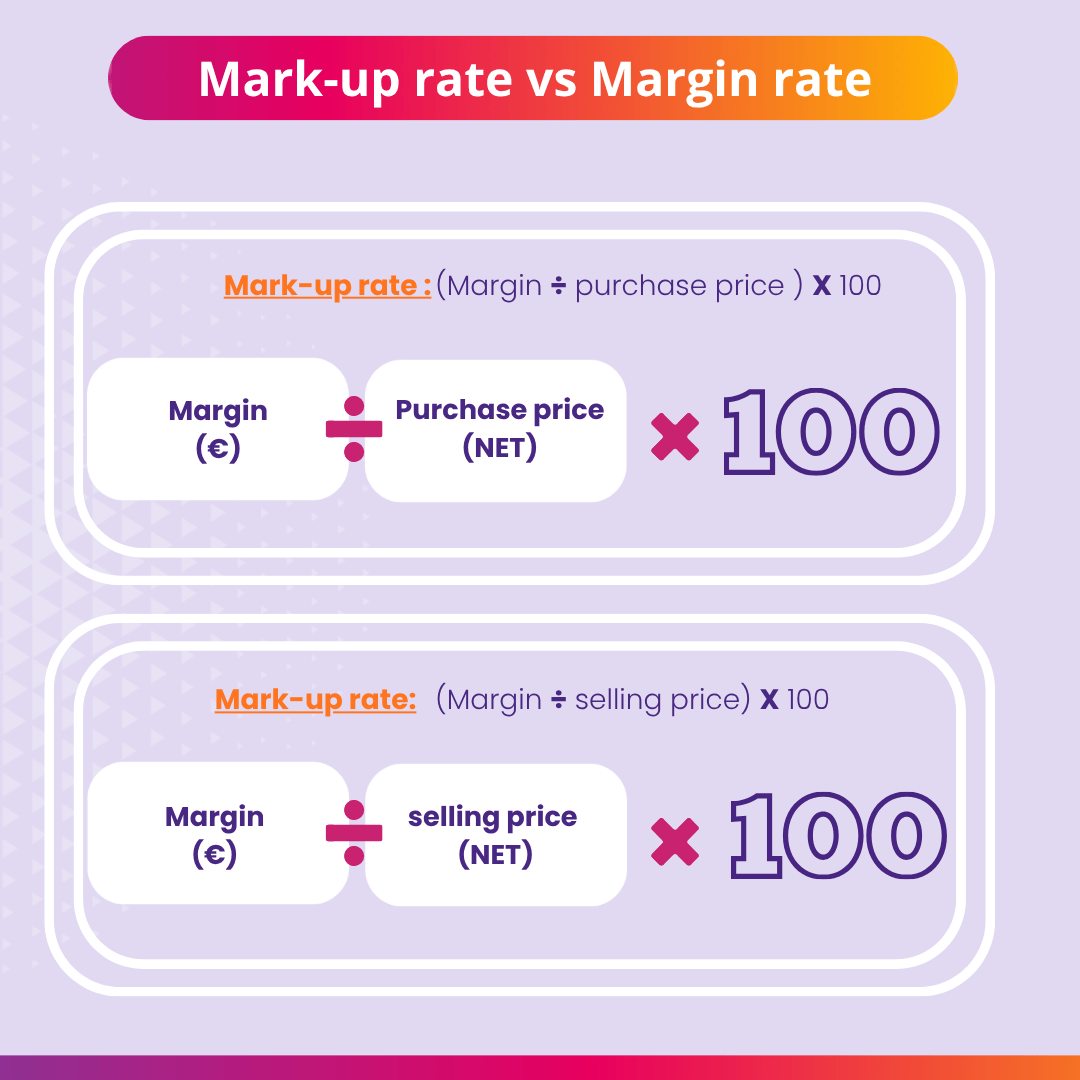

The formula to calculate it is: Mark-up rate = (Retail margin / Net selling price) x 100

Differences between the margin rate and the mark-up rate

These indicators evaluate business profitability from different perspectives.

Simply put:

- The margin rate compares the margin to the purchase cost: it shows the gross margin after a sale against the product’s purchase price.

- The markup rate compares the margin to the selling price: it measures the gross margin relative to the product’s net selling price. It represents the gross margin percentage in your business’s revenue and assesses profitability based on store-generated income.

While the margin rate is vital for planning purchase amounts and constructing financial forecasts, the mark-up rate offers a more retail-oriented view. It helps you position your business against competitors and adjust pricing policies over time.

Key points

- Margin rate = (Retail margin / Net purchase cost) × 100

Margin rate compares the gross margin to the purchase cost.- Retail margin = Net selling price – Net purchase cost

Mark-up rate = (Retail margin / Net selling price) × 100

The markup rate compares the gross margin to the net selling price.- Net vs Gross

Net (excluding taxes): price without VAT

Gross (including taxes): price including VAT

|

Indicator |

Formula |

Example (net purchase cost €60, net selling price €100) |

|

Margin (€) |

Net selling price – Net purchase cost |

40 € |

|

Margin rate |

(Margin ÷ Net purchase cost) × 100 |

(40 ÷ 60) × 100 = 66.6% |

|

Mark-up rate |

(Margin ÷ Net selling price) × 100 |

(40 ÷ 100) × 100 = 40% |

Maximizing business profitability

Improving profitability is a primary goal for any business, including sports store brands. To achieve this, optimizing your retail margin through various strategic approaches is crucial.

Optimize purchasing management

To boost profitability, start by lowering product purchase costs. Negotiate better prices with suppliers and actively seek cost-effective alternatives without sacrificing quality. Regularly assess your suppliers and foster strong relationships to secure more favorable purchase conditions.

Conduct competitive monitoring

Maintaining competitive prices requires constant market monitoring. By tracking competitors’ pricing, you can adjust your rates accordingly. If your prices are higher for similar products, consider either boosting your profit margin or offering appealing promotions to draw more customers.

Further reading: 4 retail merchandising strategies for sports stores

An efficient supply chain is essential to optimize your sports store brand’s profitability. Digital tools can significantly improve supply chain management, allowing you to automate processes, minimize errors, and save time. Effective inventory management is also crucial to prevent costly overstock and reduce waste. By optimizing storage space and maintaining ideal stock levels, you can decrease inventory management costs.

Daily business analysis

Business Intelligence is pivotal for maximizing sports store brand profitability. Decision-making analysis collects, analyzes, and interprets business data to inform strategic decisions. It identifies trends, opportunities, and potential issues. By analyzing sales data, you can pinpoint bestselling products and adjust stock levels. You can also identify peak demand periods and plan purchases accordingly.

Decision-making analysis aids in tracking financial KPIs and identifying cost reduction or margin increase opportunities. Essential store management indicators include: net revenue (including taxes), margin percentage, average basket size, sales index, customer entries, and conversion rate (if you have a counting terminal).

Further reading: Increase store traffic: 5 tips to enhance your offer

Did you know?

Orisha Commerce software provides real-time monitoring of overall and daily store activity:

- Operational statistics: detailed analyses straight from the Orisha Commerce software;

- Decision-making statistics: comparative and macro analyses to assist in making decisions on store offerings and promotions;

- Real-time updates via the BI by Orisha Commerce app, accessible from your smartphone.

FAQ

What is the difference between the margin rate and the markup rate?

Margin rate relates the margin to the purchase cost, while the markup rate compares it to the net selling price.

Example: Product purchased for €60 net, sold for €100 net → margin €40, margin rate = 66.6%, markup rate = 40%.

How is the margin rate calculated?

Formula: (Margin ÷ Net purchase cost) × 100.

Example: Product purchased for €60 net, sold for €100 net → margin €40, margin rate = 66.6%.

How is the markup rate calculated?

Formula: (Margin ÷ Net selling price) × 100.

Example: Product purchased for €60 net, sold for €100 net → margin €40, markup rate = 40%.

Should the margin rate be calculated net of taxes or gross of taxes?

Both margin rate and markup rate calculations typically use net values (excluding taxes) for a consistent comparison between purchase costs and selling prices.

Article originally published on 7 December 2024, updated on 20 November 2025